Find Our Latest Video Reviews on YouTube!

If you want to stay on top of all of our video reviews of the latest tech, be sure to check out and subscribe to the Gear Live YouTube channel, hosted by Andru Edwards! It’s free!

Thursday May 5, 2011 12:51 pm

Microsoft should buy RIM

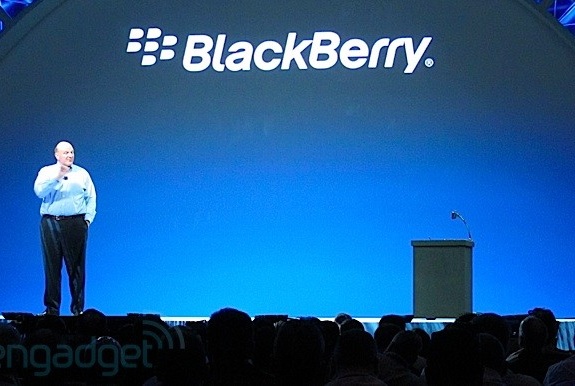

At this week's BlackBerry World trade show, everyone expected the top headliner to be the company's just-released PlayBook tablet and its new software offerings. As it turned out, the gadget ended up taking second spot to a surprise guest: Microsoft boss Steve Ballmer.

Ballmer came out during RIM co-CEO Mike Lazaridis' keynote yesterday morning to announce a partnership that would bring Microsoft's Bing search engine to BlackBerries. Search is a big deal in mobile devices, so it's fitting that a heavy hitter from Microsoft came to give its blessing, but many took the appearance of the CEO as a clear sign of bigger things to come.

Does RIM know what it's in for, though? There's considerable doubt over whether the company's strategy and platforms can be successful over the next couple of years. If they're not, Microsoft could end up owning RIM.

"Will Microsoft buy RIM? That is a possibility and a fast track for Microsoft to gain a foothold in the mobile hardware business," says Harry Wang, director of mobile research at Parks Associates. "RIM's market capitalization is only $25 billion and Microsoft has $48 billion in cash. If RIM's value drops to $15 billion, it will become an attractive target for Microsoft. Maybe Steve Ballmer was planting that seed during his keynote appearance at Blackberry World."

How we got here

Microsoft buying RIM is a rumor that's been floated before, but the Ballmer appearance—and the state of RIM in general—make it look more probable than ever. After all, Microsoft has been very aggressive in the mobile space, pushing Windows Phone 7 hard and forging an alliance with the top handset maker in the world, Nokia. Despite device sales that are probably not that great (and some are calling "catastrophic"), Microsoft is serious about making WP7 a success, and it's clearly playing the long game of mobile platforms to win.

Contrast that with RIM, which appears to have been caught napping. The company struggled to create a phone that offered a comparable experience to the iPhone or Android devices and only acquired the QNX platform, the basket in which it's putting pretty much all of its mobile eggs, about a year ago. The first QNX device, the PlayBook, had a rocky road to release and stumbled upon its debut (though Best Buy says somebody's buying it).

"[RIM] needs to craft a compelling message that makes it clear what this thing is for," says Charles Golvin, a mobile analyst with Forrester Research. "Is it a device primarily for enterprise users and makes IT managers comfortable? If that's their message, fine. But that's not the message they're putting out there today—there is a very clear consumer applicability of this product."

The confusing world of BlackBerry

RIM unveiled plenty of other new tricks at BlackBerry World, but nothing to assuage fears that the company may be at the beginning of a long decline. The Bing partnership helps RIM financially, but it doesn't really improve its devices (even though I'm sure Micorsoft would disagree). The PlayBook updates were welcome, if late, though the question of what kind of smatphone platform QNX will be remains unanswered, and may be for some time—QNX phones won't arrive until next year. It all adds up to a muddy picture.

Take the inclusion of Android apps on the tablet, which was expected. The PlayBook runs Android 2.3 "Gingerbread" (not the tablet-specific "Honeycomb"), and its presence, while convenient to customers, essentially amounts to a white flag in the app space. With extremely few QNX apps in existence, running Android as a stopgap until the platform gets up to speed seems to make sense, but it could also inadvertently marginalize the platform. After all, why should I get a QNX version of Dropbox if the Android one works fine?

"By making this choice, are they acknowledging that developers of consumer applications are placing BlackBerry at such a low priority that RIM can't see a successful path?" ponders Golvin. "Are they simply going to rely on the wealth of Android applications to satisfy that need? Will they focus their efforts on robust applications for their enterprise audience? RIM hasn't said that's their strategy, but that's how it feels to me."

Why a takeover makes sense… in about 18 months

It all adds up to an unconvincing future for the company and its platforms, and RIM's recent lowering of its financial expectations and plummeting market share doesn't help. If RIM continues to decline, the company may be ripe for a takeover, and Microsoft will certainly be examining every opportunity to expand further into the mobile space.

"I'd say RIM is on a shaky transition course," says Wang. "Its future will be decided in the next 12 months, maybe even shorter. There's a 50 percent probability that, in about two years, Microsoft will make a big and bold more to acquire large hardware vendors. RIM will be the best target because it has a user base that Microsoft is looking for: enterprise customers. And they are in the key, fast-growing area that Microsoft isn't very successful at yet, the mobile world. The need for Microsoft is so urgent in mobile, yet RIM is a perfect entry."

Can you imagine Windows Phone 7 in two years, powered by the twin engines of Nokia's global reach and RIM's enterprise base? It would be a powerhouse platform, the stuff of dreams for Ballmer—and nightmares for Apple and Google.

This article, written by Peter Pachal, originally appeared on PCMag.com and is republished on Gear Live with the permission of Ziff Davis, Inc.

Latest Gear Live Videos

Advertisement

Advertisement

Advertisement

© Gear Live Inc. {year} – User-posted content, unless source is quoted, is licensed under a Creative Commons Public Domain License. Gear Live graphics, logos, designs, page headers, button icons, videos, articles, blogs, forums, scripts and other service names are the trademarks of Gear Live Inc.