Latest Gear Live Videos

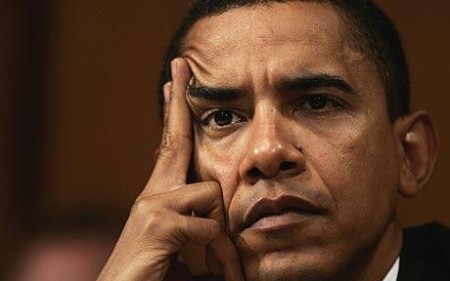

Barack Obama’s Approval Rating Below 50 Percent

Posted by Dennis Velasco Categories: Domestic Policy, Editorials, Elections, History, US Economy, Wall Street,

After enjoying a 63% approval rating after his 100 days in office, President Barack Obama’s rating has dipped below 50% to 48% after his first 500 days in office. It’s been a tougher road for Obama as his tenure as president continued, especially with polarizing issues such as economic bailouts, offshore drilling, and the big one, healthcare. While the stock market has slowly recovered, people still find themselves unemployed and obviously dissatisfied with the rate of speed the president is turning this around. So, how does Obama compare to previous presidents?

George W. Bush’s approval rating stood 77 percent in late May 2002, just eight months after the September 11 attacks. Bill Clinton was at 51 percent in late May 1994. George H.W. Bush stood at 65 percent in May of 1990. Ronald Reagan’s approval rating was at 45 percent in May of 1982. Jimmy Carter stood at 43 percent in May of 1978 and Richard Nixon was at 59 percent in May of 1970.

Luckily Obama’s administration isn’t judged only after 500 days, but they will need to start to win back the people’s administration before they know it in order for a successful re-election in 2012.

Read More  | CNN Political Ticker

| CNN Political Ticker

Advertisement

Video: The Credit Crisis Simplified

Posted by Andru Edwards Categories: Business, US Economy, Videos, Wall Street,

I think we can all admit that the current credit crisis can be a bit difficult to understand and grasp by the average person. That’s why we like this video by Jonathan Jarvis, The Crisis of Credit Visualized. He breaks it down into plain English surprisingly well. Check it out, and let us know what you think in the comments.

Werd: Bailout - Part Four

Posted by Patrick Snajder Categories: Domestic Policy, Editorials, US Economy, Videos, Wall Street,

We’re bailing Thursday out with some videos. Sit back, listen, and we can explore inner and outer space together, forever.

“A working class hero is something to be.”

Click to continue reading Werd: Bailout - Part Four

Read More  | Hicks on America

| Hicks on America

Werd: Bailout - Part Two

Posted by Patrick Snajder Categories: Domestic Policy, Editorials, US Economy, Wall Street,

I am not a master of finance, to say the very least. [You can find my full opinion on debt and credit here.]

While 80% of the freshman when I was a senior at the University of Richmond in 2000 would go on to earn a major or minor degree from our Business School, I never took a single class at the School, and only ever held disdain for those that did.

It should be no coincidence, then, that almost ten years later, I am still buried underneath school loans and have seen my best entrepreneurial ideas die quick deaths due to my ignorance in all areas involving money. My relationship to the American economy, to this point, has been adversarial: we both cared little for one another and worked towards the other’s hopeful demise. But it is not with joy that I witness the economy’s current unhealthy state, as its disappointment only furthers a lesser state of my personal economy. If the current American economy were to die, a part of my life would surely die with it.

Click to continue reading Werd: Bailout - Part Two

Werd: Bailout - Part One

Posted by Patrick Snajder Categories: Domestic Policy, Editorials, Media, Taxes, US Economy, Wall Street,

In honor of Merriam-Webster’s 2008 word of the year, bailout, we will focus this week’s efforts of The Werd on the big story of the year.

To start the discussion, I will suggest these two great charts:

A Visual Guide to the Financial Crisis - Part One

A Visual Guide to the Financial Crisis - Part Two

Part One explains the many reasons for the financial crisis; Part Two suggests an alternative bailout that punishes those who benefitted from the bubbles without extracting social funds already marked for public programs such as social security or retirement funds (as the current bailouts do). This expert work shows how solutions to our problems are not beyond our ability, but merely beyond the imagination of our current leadership.

We’ll dig in on Tuesday with my precious take.

BAILOUT SERIES

Bailout - Part One

Bailout - Part Two

Bailout - Part Three

Bailout - Part Four

Bailout - Part Five

Read More  | Merriam-Webster's 2008 Word of the Year

| Merriam-Webster's 2008 Word of the Year

Werd: Pirate - Part Three

Posted by Patrick Snajder Categories: Business, Editorials, Humor, US Economy, Wall Street,

Where, precisely, is the line crossed that separates Robin Hood, the hero to the lower class, from Robin Hood, terrorist?

As usual, it seems to be a matter of perspective. If you were sending gilded coins to your dear mother by way of carriage to pay for her The Plague medicine and Robin Hood up and stole your ducats, surely you would see Hood as the terrorist. Even if the money Hood swiped was going to pay for the conspiracy to infect the lower class with The Plague, chances are that the sender would want Hood’s head on a platter. I guess the overriding feeling is that if people take things that belong to you, you tend to want revenge or at least want to call them a thief, hoping that they will be prosecuted so you can get back the money that rightfully belongs to you.

But, if you are struggling to make ends meet as a cobbler and you can’t afford your child’s The Plague medicine, then when Hood arrives at your door with a burlap sack full of free money, surely you would sing his graces. Thanks to the beneficence of your green-suited savior, little Sally will live to see another day. So what if some highfalutin dingleberry lost the spending money for his elaborate vacation? Is his happiness more important than little Sally’s health? From the viewpoint of the cobbler’s eye: Hood is a hero.

All of us have either found ourselves in moments of Hood-worship or Hood-hate. If we follow the genealogy of the dollar bills in our own accounts, surely we will find some dollars buried in our past that have known thievery and charity. Some times our lives are subsidized for our benefit and some times we subsidize others for their benefit.

Click to continue reading Werd: Pirate - Part Three

Read More  | Ladhe burns his bridges

| Ladhe burns his bridges

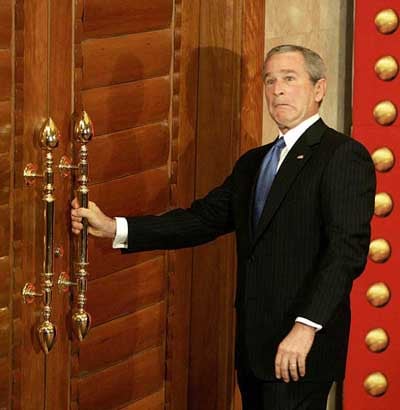

The Bush Legacy

Posted by Charles Mitri Categories: Business, Domestic Policy, Editorials, Foreign Policy, Foreign Relations, History, US Economy, Wall Street, War,

When George W. Bush vacates the White House on January 20, 2009, the floodgates will open, as political pundits line up to take pot shots at his eight years as Chief Executive.

Presidential rankings are nothing new. Every former president has one and have eschewed the usual practice of getting an objective view of a president’s legacy after leaving office. These days, the Internet and instant readers’ polls have made the tried and true method of waiting a few years for a ranking virtually obsolete.

Down to business. America’s best presidents are a very elite group, usually judged by how well they react during a crisis. At the top of the heap there are Lincoln, FDR, Washington, Jefferson, Teddy Roosevelt and Woodrow Wilson. Over the last few years there’s been a shift in rankings at the bottom of the barrel. Grant and Harding used to occupy the number one and two slots. Over recent years, James Buchanan has assumed the bottom spot with Herbert Hoover right on his heels. Buchanan gets the blame for the Civil War. Hoover is charged with the 1929 stock market crash and onset of the Great Depression two years later.

Click to continue reading The Bush Legacy

Barack Obama’s First Hundred Days

Posted by Charles Mitri Categories: Domestic Policy, Editorials, Education, Foreign Policy, Foreign Relations, Taxes, US Economy, Wall Street, War,

So… January 20, 2009, history takes its latest bow when President-Elect Barack Obama is sworn in as America’s 44th Chief Executive. The fortunate ones lucky enough to secure Inauguration tickets will brave arctic temperatures as the rest of America watches this latest chapter in US history unfold on an ocean of televisions from Seattle to the Florida Keys.

January 21, 2009 will mark the real onset of what might be called the Altering Era. That’s the day the President-Elect enters the Oval Office and starts work on a world of problems. What follows is a best guess at what to expect from Barack’s first hundred days in office.

Click to continue reading Barack Obama’s First Hundred Days

Obama’s First Weekly Address Goes Virtual

Posted by Milo Taibi Categories: Domestic Policy, Media, Videos, Wall Street,

On November 14th, President-elect Barack Obama posted his first weekly address on youtube. The address’ length was about three minutes and thirty seconds long, briefly addressing a variety of issues. Among other topics, (such as health care, the economic crisis, and education) President-elect Obama discussed his green energy plans: “...investing $150 billion dollars to build an American green energy economy that will create five million new jobs, while freeing out nation of the tyranny of foreign oil, and saving our planet for our children.”

The address didn’t go particularly far into specifics, but it did give a general consensus of Obama’s views on issues that will be of the utmost importance when his first Presidential term begins. Obama knows as well as anyone that he is inheriting a financial mess right off the bat on January 20th, so he wasted no time on bringing up the subject on his first address.

Click to continue reading Obama’s First Weekly Address Goes Virtual

Read More  | Change.gov

| Change.gov

Big Trouble in Little Washington

Posted by George Regal Categories: Editorials, Law, Site Features, US Economy, Wall Street,

According to President Bush this bailout is a good deal for Main Street. He assures us that the tax dollars invested will pay for themselves and then some. Oh really? That’s the definition of a good investment. Well, if this is such a good investment why aren’t private investors rushing in to snap up these assets and companies at bargain prices? Hint: Because they aren’t good investments!

Adding the $700 billion to the rest of the actions taken recently (Bear Stearns, AIG, Fannie Mae and Freddie Mac, FHA rescue bill, and the rest) the total balloons to a whopping $1.8 trillion, and counting! Where is this money coming from? Unfortunately for us, it’s coming out of thin air! Anytime the government spends more than it receives in tax revenue, they engage in deficit spending. This is accomplished by the Treasury Department auctioning Treasury Securities on the open market. These are the same securities that China has purchased to the tune of $2.2 trillion. With me so far?

Click to continue reading Big Trouble in Little Washington

Advertisement

© Gear Live Media, LLC. 2007 – User-posted content, unless source is quoted, is licensed under a Creative Commons Public Domain License. Gear Live graphics, logos, designs, page headers, button icons, videos, articles, blogs, forums, scripts and other service names are the trademarks of Gear Live Inc.